30+ Total interest paid calculator

The incentive is gradually reduced every 30 minutes. Compare and see which option is better for you after interest fees and rates.

Calculate Html Element Total Width And Height Css Model Box

Despite appearances 10 APR is equivalent to 1047 APY.

. Almost any data field on this form may be calculated. Please use the Matic Staking Calculator to estimate your rewards under current or future network conditions. To do so you need to multiply 417 by 30 2 years 24 months half a year 6 months.

Related Investment Calculator Average Return Calculator ROI Calculator. Matic is allocating 12 of its total supply of 10 billion tokens towards staking rewards. Use Bankrates loan interest calculator to find out your total interest on any loan.

Yes complete amortization table. In comparison if a 100 savings account includes an APY of 1047 the interest received at the end of the year is. Compound Daily Interest Calculator.

See the monthly cost on a 250000 mortgage over 15- or 30-years. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Loan Interest Calculator Example.

Please refer to the Compound Interest Calculator to convert between APY and APR or interest rates of different compounding frequencies. Brets mortgageloan amortization schedule calculator. Calculating the total interest paid on your loan will show you the true cost of.

These 12 billion tokens will be the staking incentive for the first five years. Basic interest calculator helps track monthly interest payments clearly illustrating which portion of your revolving credit payment is applied toward reducing your principal balance. B4 is the first period you pay the bank while B5 is.

In the mortgage example above over 30 years the 300000 mortgage will cost nearly 600000 total which nearly doubles the original cost of the loan. Calculate loan payment payoff time balloon interest rate even negative amortizations. When the housing market is hot many people chase it buying near the peak with interest-only loans.

The n variable is the frequency of interest paid in a time period and t is the number of time periods. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

For example you may want to calculate the total interest you will receive during next two and a half years. Paying an Interest-Only Mortgage. The interest rate is defined by r.

P is the principal balance of financial instruments which can be certificates of deposit bonds savings accounts and many others. While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. How do Realtors get paid.

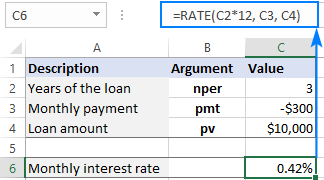

B3 is the years of the loan B312 will get the total number of periods months during the loan. The concept of interest is the backbone behind most financial instruments in the world. 100 1047 1047.

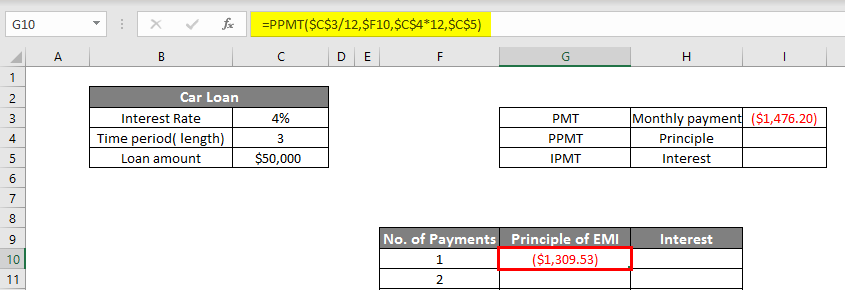

A 30-year fixed-rate mortgage is the. The calculator will help you easily see that despite the higher interest rate the 15-year loan is a cheaper option. The interest and principal paid the remaining balance and the total interest paid by the end of each month are computed.

Obviously all of the above calculations might be done quickly and painlessly with our smart calculator. 417 30 12083. For example you may be deciding between a 15-year loan at 6 percent or a 30-year loan at 4 percent.

In the formula B2 is the annual loan interest rate B212 will get the monthly rate. This tool helps buyers calculate current interest-only payments but most interest-only loans are adjustable rate mortgages ARMs. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

It is the basis of everything from a personal savings plan to the long term growth of the stock market. If you paid an extra 1091 every month for a 15-year amortization youll save a total of 72815 in interest. If you want to lower your mortgage payments and choose to get a 30-year amortization instead youll save 268 per month through lower payments but end up paying 38293 more in interest.

B1 is the total amount of loan. Your total interest paid. Total interest paid during term using IO payments.

Multiply 1250 by your number of payments 180 12 payments per year15 years to get 225000. Loan Term in Years. The monthly payment and the total interest paid over the life.

Interest is the compensation paid by the borrower to the lender for the use of money as a percent or an amount. Paid during the year the remaining balance at years end and the total interest paid by the end of each year are calculated. Rates locked in for duration of loan.

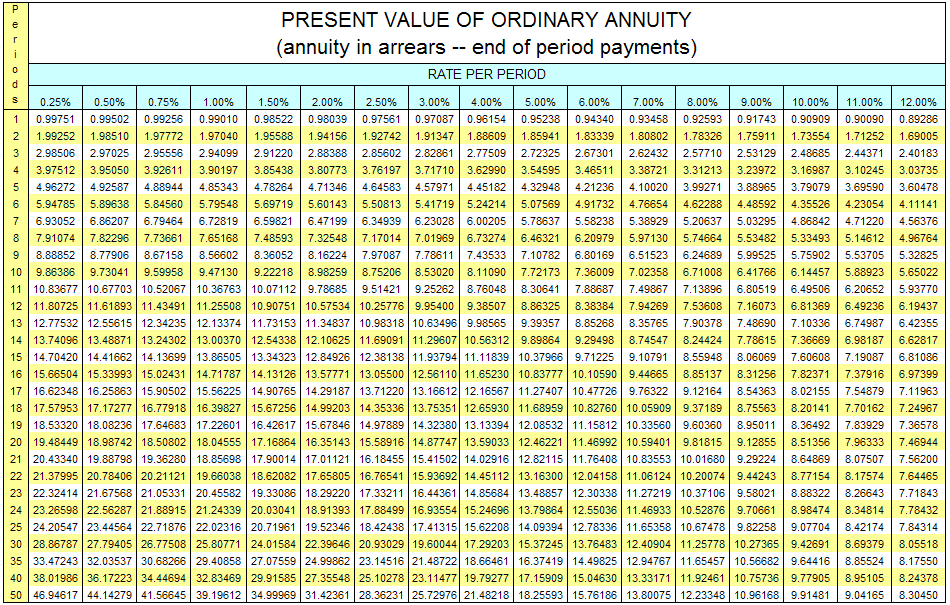

Lottery Winner S Dilemma Lump Sum Or Annuity

Late Payment Interest Calculator For Past Due Invoices

Pin On Budget

Calculate Compound Interest In Excel How To Calculate

Calculate Child Support Payments Child Support Calculator Calculate Child Sup Child Support Laws Ideas Of C Child Support Quotes Child Support Supportive

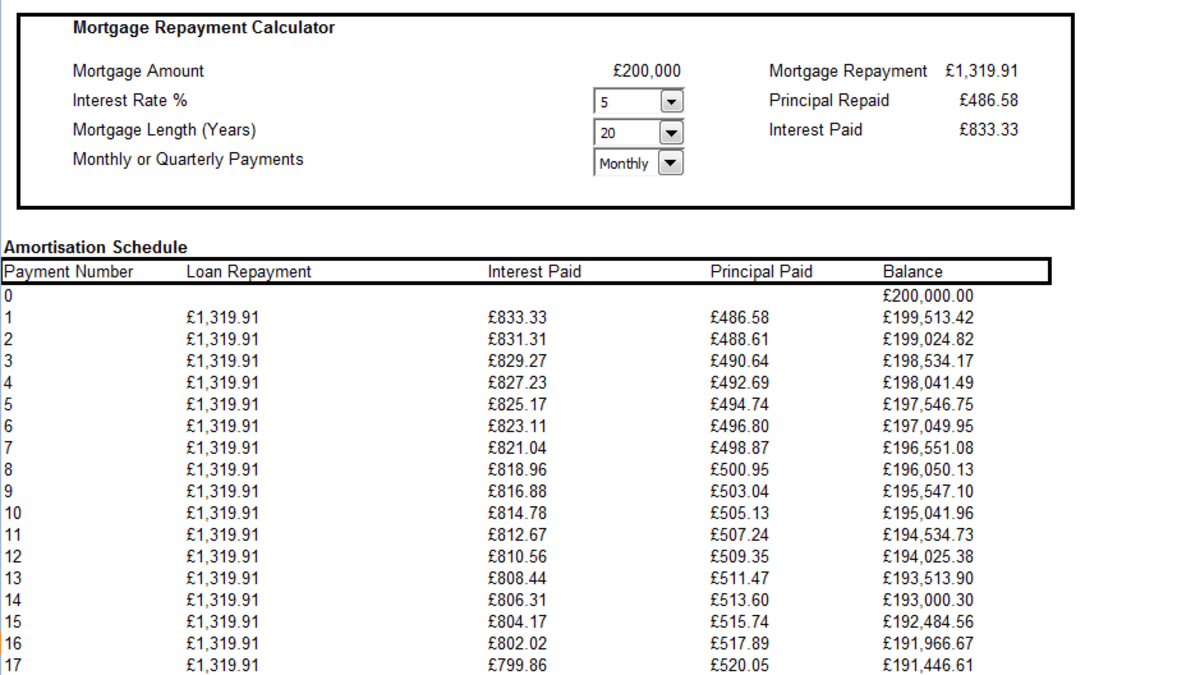

Creating An Amortization Loan Or Mortgage Schedule Using Excel 2007 And Excel 2010 Hubpages

These Monthly Money Saving Challenges You Need To Try Money Bliss Saving Money Budget Money Saving Plan Money Plan

Airbnb Stay Tracker And Management Expense Cleaning Fee Etsy Rental Income Rental Property Management Airbnb

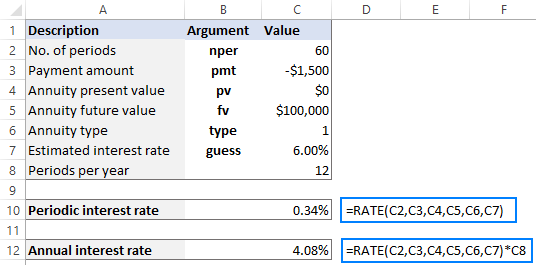

Using Rate Function In Excel To Calculate Interest Rate

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free Credit Card Payment Calculator Template In Excel Youtube

Compound Interest Formula And Calculator For Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Comparison Spreadsheet Budgeting Worksheets Budget Spreadsheet Template Budget Spreadsheet

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

Using Rate Function In Excel To Calculate Interest Rate

Excel Mortgage Calculator How To Calculate Loan Payments In Excel